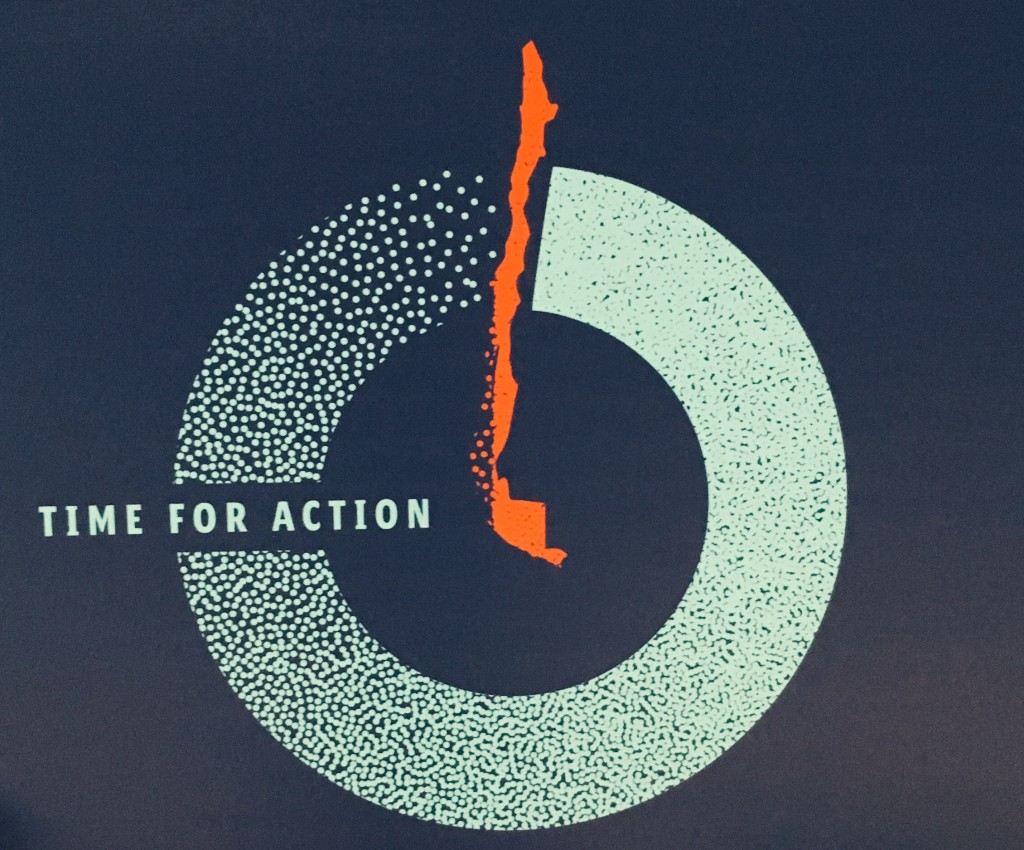

This is being called the “Action COP”, and yesterday’s opening plenaries focused again and again on turning pledges into concrete action as countries prepare their climate action plans for next year. Chile’s graphic for the COP leans in to its long-skinny resemblance to the hand of a clock:

Article 6 of the Paris Agreement, which lays out the rules for global carbon markets, has turned out to be a major sticking point in the negotiations and is a key outstanding issue on the negotiating table this year. A well-designed system can decrease abatement costs, direct investments to areas where they can most effectively reduce emissions, and allow countries to increase ambitions for their targets. A poorly-designed system can make NDCs meaningless by flooding international markets with credits that do not reflect actual reductions in emissions, whether because they were banked under less-restrictive systems, are double-counted through multiple NDCs, or reflect “reductions” from artificially high business-as-usual emissions. This afternoon I attended an academic session on designing carbon markets to avoid some of these pitfalls, including a range of interesting ways to test for “additionality”, i.e. whether a project reflects a real reduction in emissions below BAU levels. (For example, should switching to solar count toward emission reductions even when it’s the lowest-cost option for power generation?) . It’s an incredibly interesting issue where the technical details are extremely important and very political. I don’t expect we’ll see too much progress this week, but I’ll be watching closely after I get back to see what happens in week 2.

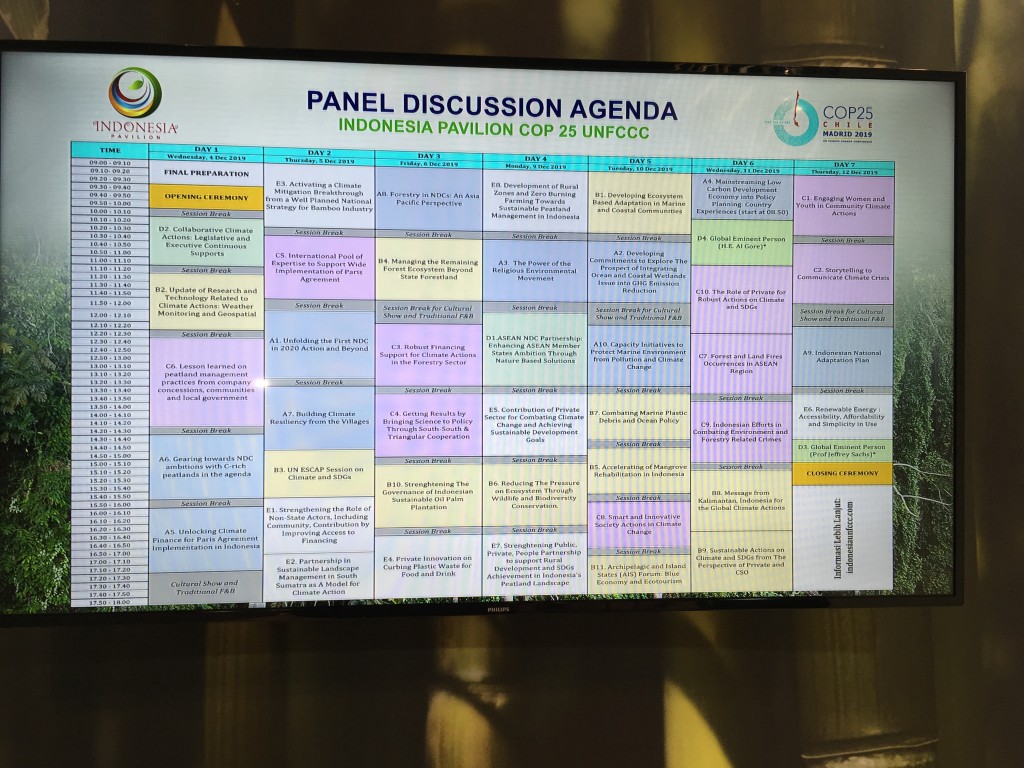

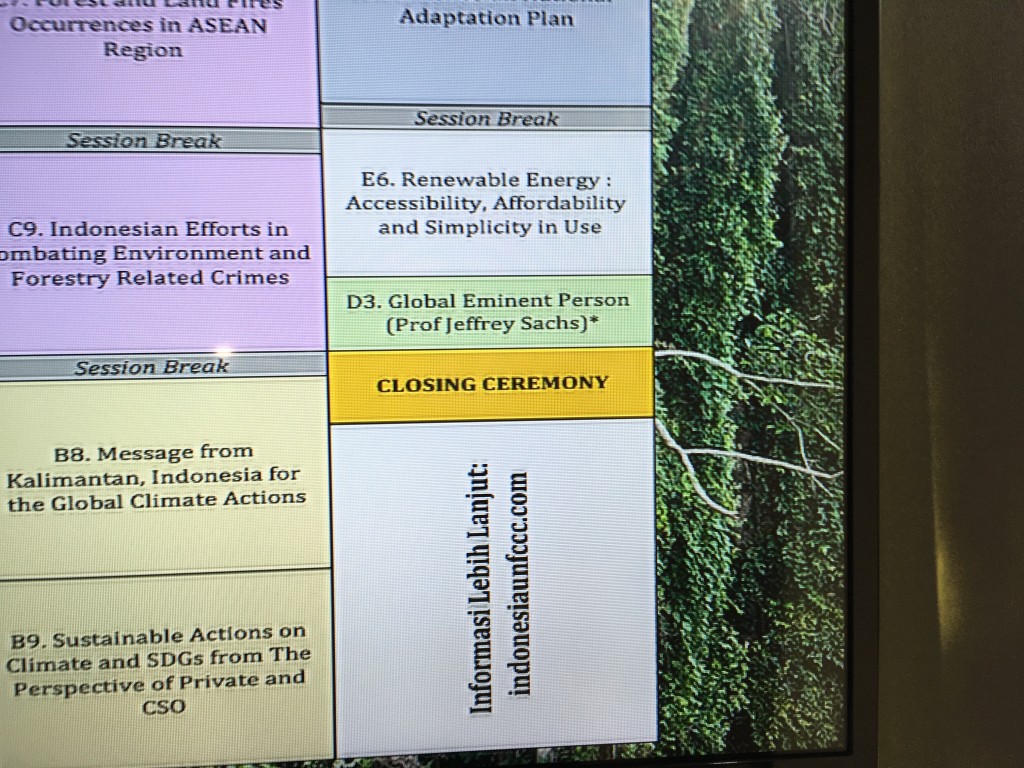

Finally, an easter egg for econ folks was this event hosted by the Indonesia pavilion:

Global eminent person Jeffrey Sachs is speaking next Thursday — following up on his talk at Swarthmore in October! (There’s another global eminent person speaking the day before: H.E. Al Gore.)

Thanks for the report – interesting to hear what issues are on the table. Are you hearing any skepticism about market-based mechanisms at all, either inside or (probably especially) outside the main negotiating discussions?

There’s a real worry that a bad trading scheme could undermine the Paris Agreement by making the NDCs meaningless. I haven’t heard skepticism here yet about carbon pricing fundamentally, but that could be a feature of the kinds of events I’ve been going to! I have heard people express the idea that it will take too long to set up markets and that we should move more quickly with direct regulation with the kinds of things that we know need to happen (e.g. decarbonizing the energy sector) rather than waiting for a carbon tax or tradable credits.